- Automatic Sales Tax Calculator Estimator

- Automatic Sales Tax Calculator Paycheck Calculator

- Automatic Sales Tax Calculator 2019

- Automatic Sales Tax Calculator Estimate

The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.

What is Sales Tax?

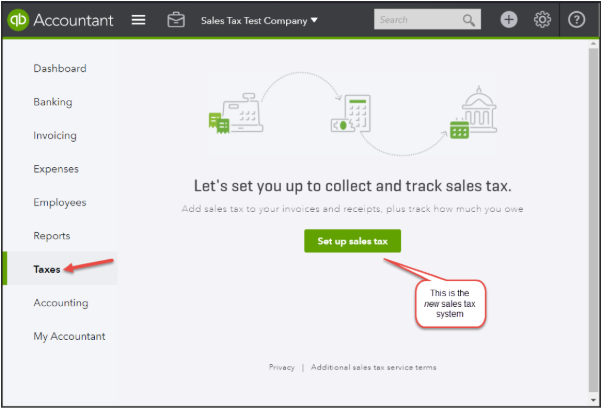

North Carolina has a 4.75% statewide sales tax rate, but also has 325 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.188% on top of the state tax. QuickBooks can automatically do the sales tax calculations for you on your invoices and receipts for easy and accurate filings. Then, it lets you know when your tax payment is due, so you can file on time and avoid extra fees.

- Instantly calculate tax with the help of a sales calculator or you can contact your state taxing authority. Local rates Some states also allow local areas like counties and small cities to set a sales tax rate.

- The Tax-Rates.org Louisiana Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Louisiana. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Louisiana, local counties, cities, and special taxation districts.

- Calculating tax for online purchases is significantly more complicated than in person sales. Your digital customers can be anywhere, introducing a number of variables into sales tax formulation. Fortunately, the sales tax calculator determines the proper tax rate for every customer automatically.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT), or goods and services tax (GST), which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are after-tax final values, which includes the sales tax.

U.S. Sales Tax

In the United States, sales tax at the federal level does not exist. At the state level, all (including District of Columbia, Puerto Rico, and Guam) but five states do not have statewide sales tax. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play. Unlike VAT (which is not imposed in the U.S.), sales tax is only enforced on retail purchases; most transactions of goods or services between businesses are not subject to sales tax.

The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. In Texas, prescription medicine and food seeds are exempt from taxation. Vermont has a 6% general sales tax, but an additional 10% tax is added to purchases of alcoholic drinks that are immediately consumed. These are only several examples of differences in taxation in different jurisdictions. Rules and regulations regarding sales tax varies widely from state to state.

On average, the impact of sales tax on Americans is about 2 percent of their personal income. Sales tax provides nearly one-third of state government revenue and is second only to the income tax in terms of importance as a source of revenue. Reliance on the sales tax varies widely by state. Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. Florida, Washington, Tennessee, and Texas all generate more than 50 percent of their tax revenue from the sales tax, and several of these states raise nearly 60 percent of their tax revenue from the sales tax. New York, on the other hand, only raises about 20 percent of its revenues from the sales tax.

The following is an overview of the sales tax rates for different states.

| State | General State Sales Tax | Max Tax Rate with Local/City Sale Tax |

| Alabama | 4% | 13.5% |

| Alaska | 0% | 7% |

| Arizona | 5.6% | 10.725% |

| Arkansas | 6.5% | 11.625% |

| California | 7.25% | 10.5% |

| Colorado | 2.9% | 10% |

| Connecticut | 6.35% | 6.35% |

| Delaware | 0% | 0% |

| District of Columbia | 5.75% | 5.75% |

| Florida | 6% | 7.5% |

| Georgia | 4% | 8% |

| Guam | 4% | 4% |

| Hawaii | 4.166% | 4.712% |

| Idaho | 6% | 8.5% |

| Illinois | 6.25% | 10.25% |

| Indiana | 7% | 7% |

| Iowa | 6% | 7% |

| Kansas | 6.5% | 11.5% |

| Kentucky | 6% | 6% |

| Louisiana | 4.45% | 11.45% |

| Maine | 5.5% | 5.5% |

| Maryland | 6% | 6% |

| Massachusetts | 6.25% | 6.25% |

| Michigan | 6% | 6% |

| Minnesota | 6.875% | 7.875% |

| Mississippi | 7% | 7.25% |

| Missouri | 4.225% | 10.85% |

| Montana | 0% | 0% |

| Nebraska | 5.5% | 7.5% |

| Nevada | 6.85% | 8.25% |

| New Hampshire | 0% | 0% |

| New Jersey | 6.625% | 12.625% |

| New Mexico | 5.125% | 8.688% |

| New York | 4% | 8.875% |

| North Carolina | 4.75% | 7.50% |

| North Dakota | 5% | 8% |

| Ohio | 5.75% | 8% |

| Oklahoma | 4.5% | 11% |

| Oregon | 0% | 0% |

| Pennsylvania | 6% | 8% |

| Puerto Rico | 10.5% | 11.5% |

| Rhode Island | 7% | 7% |

| South Carolina | 6% | 9% |

| South Dakota | 4% | 6% |

| Tennessee | 7% | 9.75% |

| Texas | 6.25% | 8.25% |

| Utah | 5.95% | 8.35% |

| Vermont | 6% | 7% |

| Virginia | 5.3% | 6% |

| Washington | 6.5% | 10.4% |

| West Virginia | 6% | 7% |

| Wisconsin | 5% | 6.75% |

| Wyoming | 4% | 6% |

U.S. History of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This together with other events led to the American Revolution. Therefore, the birth of the U.S. had partly to do with controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn't take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

How to Deduct Sales Tax in the U.S.

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction because it is simpler and hassle-free. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year's worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

After the choice between standard or itemized deductions has been made, taxpayers have to make another decision regarding whether or not to claim either state and local income taxes, or sales taxes (but not both). Most taxpayers choose to deduct income taxes as it typically results in a larger figure. With that said, it may be better for taxpayers who made large purchases during the year to deduct sales tax instead of income tax if their total sales tax payments exceed state income tax. Taxpayers who paid for a new car, wedding, engagement ring, vacation, or multiple major appliances during a tax year can potentially have a greater sales tax payment than income tax payment. In reality, less than 2% of Americans claim sales tax as a deduction each year.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Value-Added Tax (VAT)

VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. Countries that impose a VAT can also impose it on imported and exported goods. All participants in a supply chain, such as wholesalers, distributors, suppliers, manufacturers, and retailers, will usually need to pay VAT, not just the end consumer, as is done with U.S. sales tax. VAT can be calculated as the sales price minus the costs of materials or parts used that have been taxed already.

A 1979 study published by the Tax Foundation offered some insight into arguments for or against VAT as compared to sales tax. Perhaps the greatest benefit of taxation via VAT is that because taxation applies at every step of the chain of production of a good, tax evasion becomes difficult. Also, there are stronger incentives to control costs when all participants involved in a supply chain are taxed. Compared to sales tax, VAT has the ability to raise more revenue at a given rate. On the other hand, VAT tends to be regressive; that is, it takes proportionately greater amounts from those with lower incomes. Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. For more information about or to do calculations involving VAT, please visit the VAT Calculator.

Goods and Services Tax (GST)

The Goods and Services Tax (GST) is similar to VAT. It is an indirect sales tax applied to certain goods and services at multiple instances in a supply chain. Taxation across multiple countries that impose either a 'GST' or 'VAT' are so vastly different that neither word can properly define them. The countries that define their 'sales tax' as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia.

Forty-five states and Washington D.C. all have a sales tax. Find out what each state has to say about sales tax here. Sales tax is governed at the state level, meaning each state sets their own laws and rules when it comes to sales tax. There is no “national” or “federal” sales tax.

Sales tax rates can be made up of a variety of factors:

State rates

Each state with a sales tax has a statewide sales tax rate. States use sales tax to pay for budget items like roads and public safety. The state sales tax rate is the rate that is charged on tangible personal property (and sometimes services) across the state. These usually range from 4-7%. For example, the state rate in New York is 4% while the state sales tax rate in Tennessee is 7%.

Automatic Sales Tax Calculator Estimator

In some states, the sales tax rate stops there. Ten states don't have local sales tax rates, so if you make a sale to a buyer in one of those states (Ex: Michigan) then you'd just charge them the Michigan state sales tax rate of 6%.

Local rates

The other states, though, also allow local areas such as counties and cities to set a sales tax rate. In this case, you may collect a state sales tax rate, but also a percentage set by the county or city.

Special taxing district rates

Some states may have a 4th type of rate – as special taxing district. Just like states use sales tax to pay for public safety, etc. so do local areas. They may raise sales tax if they’re in a budget crunch, or join with several surrounding areas to create a special, limited time sales tax to pay for a publicly-funded venture, like a new school, park, or rail system.

Automatic Sales Tax Calculator Paycheck Calculator

Example: Centennial, Colorado's total sales tax rate is 6.75%. But that rate is made up of many different rates, like:

Automatic Sales Tax Calculator 2019

Automatic Sales Tax Calculator Estimate

| Colorado State Rate | 2.9% |

| Arapahoe County | 0.25% |

| City of Centennial | 2.5% |

| Regional Transportation District Tax | 1% |

| Scientific and Cultural Facilities District | 0.1% |

| Total | 6.75% |

|---|

As you can see, buyers in Centennial, CO pay not just state, city and county sales tax rates but also two separate district taxes.